Is It Possible That the Stock Market Could Crash Again

xi Min Read | Apr half-dozen, 2022

For investors, the start of 2022 has been quite a roller coaster. Worries about inflation and rising interest rates sent stocks tumbling in January, and Russia invading Ukraine in February sparked another wave of volatility for the stock market.ane , 2

All this fearfulness and dubiety about what's coming side by side has led to whispers nigh the potential of some other stock market crash—the commencement since the start of the coronavirus pandemic back in 2020.

So, will we encounter the stock market place crash during the rest of 2022? Allow'southward accept a look at some of the major factors (with a cool, level head) to better empathize where the market is going.

What Is a Stock Market place Crash?

A stock marketplace crash is a sudden and big drop in the value of stocks that'south caused past investors selling their shares quickly. That drives down the value of stocks for other shareholders, who also start selling their shares to try to cutting their losses. The end event is that people could lose a lot of the money they invested.

Craft a harder-working money plan with a trusted financial pro.

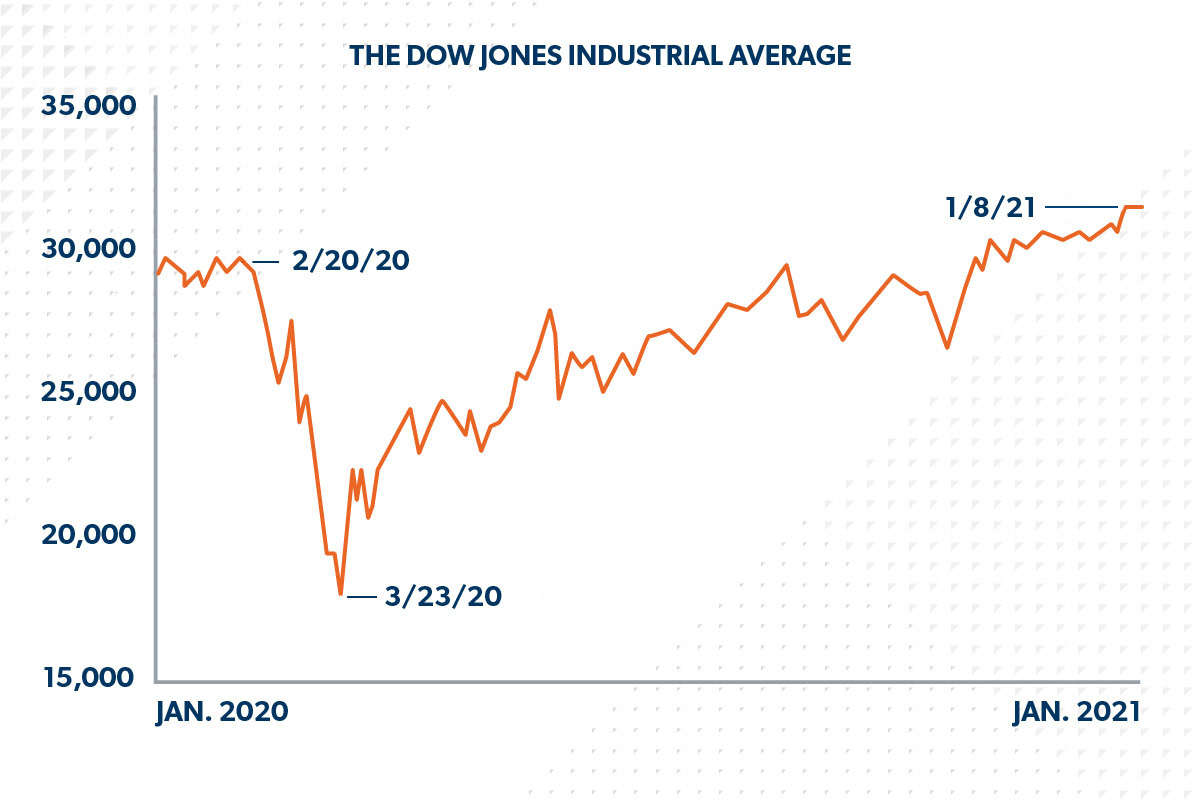

To assist us visualize how well the stock marketplace is (or isn't) doing, we await at indexes like the Dow Jones Industrial Average (DJIA), the S&P 500 and the Nasdaq. If you look at a historical graph of one of these indexes, yous can see why we apply the termcrash. It's like watching a airplane take a nose dive.

Previous Stock Market Crashes: Examples From History

Throughout history, the market place has gone through a lot of extreme ups and downs. When we look back, we're reminded that, yes, a marketplace crash is a very difficult thing to go through, but it's something we can and will overcome.

- The Dandy Depression,1929: Over the course of a few days, the DJIA dropped nigh 25%.three Information technology took a trivial over a decade for the economy to get back to predepression levels. It was the industry from World War II that helped get things back upward and running.

- The Stock Market Crash, 1987: The marketplace lost 22.six% of its value in ane mean solar day known equally Blackness Monday.4 Merely within 2 years, information technology had recovered everything information technology had lost.five

- September 11, 2001:Terrorist attacks in our country caused a major hit on the market, but it corrected itself super quick. Butone calendar month after, the stock market place had returned to September 10 levels and kept going upwardly throughout the end of 2001.6

- The Neat Recession, 2008:The DJIA lost more than 50% of its value in a really short fourth dimension.7 Simply after a couple of years, the market was stronger than ever before—we were basically in a bull market (a period of stiff economical growth) from 2009 to just before the coronavirus crash.

- The Coronavirus Crash, 2020: In March of 2020, the COVID-19 pandemic triggered the most rapid global crash in financial history. Still, the stock market recovered ground pretty quick, and the yr closed with tape highs.8

So, continue your head up. Chances are, you lot've already lived through at to the lowest degree two major crashes and recessions. It's part of the rhythm of life!

What Causes a Stock Market Crash?

A stock market crash is caused by ii things: a dramatic drop in stock prices and panic. Hither's how it works: Stocks are small shares of a company, and investors who purchase them brand a profit when the value of their stock goes upwards. The value and the price of those stocks are based on how well investors believe the visitor will practise. So, if they call up the company they're invested in is headed for hard times, they sell that stock in an attempt to exit before the value drops.

The reality is, panic has only as big of a role in a stock market place crash as the actual economic issues that cause it.

Let'southward walk through an example from the coronavirus pandemic that shows you just how powerful panic is. Every bit news of the virus spread, grocery and convenience stores all beyond the earth sold out of toilet paper in a matter of days. Was there a toilet paper shortage? Well, yes and no. There wasn't a shortagebefore people started panicking. But when people lost their minds and started stocking up on toilet paper, their deportmentcreated a shortage!

The same kind of panic tin can trigger a stock marketplace crash. In one case investors run across other investors selling off their stocks, they get pretty nervous. So, stock values start to dip, and more than investors sell their shares. Adjacent thing y'all know, everyone is dumping their stocks, and the market is in a full-fledged crash. Look out below!

Our point here is this: The stock market place's value is 100% based on perception andprediction of the future. No wonder information technology feels like such a roller-coaster ride!

How Did the Coronavirus Crash Affect the Stock Market?

Let'due south pretend nosotros've got a time machine to take us back to March of 2020 when the coronavirus was officially declared a pandemic (don't worry, nosotros won't stay long). While people were rampage-watchingTiger King or swarming the supermarkets to buy toilet paper, the global economy was in chaos. Supply chains footing to a halt. Entire industries shut down overnight. And the stock market crashed—big time.

Back in the early days of the pandemic, the stock market took usa all on a ride. Global markets (not but hither in the U.Southward.) took a huge plunge, triggering a short-lived bear market place (where the stock market falls by at to the lowest degree xx%) and an economic recession in the next few months. If yous were checking your 401(chiliad) during those days, you probably felt panicked as yous watched your savings disappear.

But afterward the initial nose dive in March, the market started to inch its way dorsum to recovery. And by the time the New year's Eve ball dropped on December 31, 2020, the stock market had regained all of its lost footing—and and then some! Did you take hold of that? All of the major indexes grew in 2020:

- The Due south&P 500 gained 15.half-dozen%.

- The Nasdaq gained 43.8%.

- The Dow Jones gained 6.5%.ix

Looking dorsum, we can see that even the big, scary coronavirus crash didn't knock us out for long. In fact, economists are at present saying the recession from the coronavirus crash was the shortest on tape—only lasting2 months!10

Volition the Stock Market Crash in 2022?

Let's get ane thing direct:No i can perfectly predict whether the stock market is going to crash during the rest of 2022. Simply think dorsum to everything that has happened these past few years—you lot can't make this stuff up!

So, volition the stock market crash in 2022? All we can practice is look at the things that will influence the market and your investments throughout the rest of the twelvemonth. Allow's dig into the specifics and where we are at present.

Reasons to Feel Cautious Most the Stock Market place in 2022:

- High inflation: Between all those stimulus checks and supply chain problems, nosotros've seen a dramatic increment in the price of, well, everything—especially in grocery stores and at the gas pump—which has led to investors being cautious and consumers spending less.

- Rising interest rates: In an effort to fight aggrandizement, the Federal Reserve started raising interest rates in early on 2022—and there could be more rate hikes on the way presently. While this could slow downwards inflation, information technology could also trigger another U.South. recession.11

- Tensions in Europe: Russia's invasion of Ukraine sent shockwaves effectually the world and could cause investors heartburn over the next few months. Only if history shows us anything, the stock market usually recovers and is higher a year after major geopolitical or historical events.12 And then hang tight.

Reasons to Feel Optimistic About the Stock Market in 2022:

- COVID-19 fading: As the coronavirus crunch eased, putting the Delta and Omicron variants in the rearview mirror, we've already seen more optimism, movement and spending. There's a lot of pent-upward free energy in our country, and people are gear up to get out and most!

- Unemployment falling: In March 2022, the unemployment rate improved to three.6%—that's the lowest level since February 2020 correct before the pandemic started to wreak havoc on the U.South. economy. That means more than people are continuing to look for jobs and are finding them.thirteen

- New industries growing: Specific industries—tech, e-commerce and biotech—gained tons of basis during the pandemic and volition continue to grow and requite investors reason to feel confident.14

We can run numbers and make predictions all 24-hour interval long, but at the end of the 24-hour interval, we have no idea what's going to happen for the rest of 2022—no one does. So permit's be the kind of people who are prepared for annihilation the future has in store.

What to Do During a Stock Market Crash

If the market placedoescrash once more in 2022, remind yourself that you lived through another crash simply a few years ago. In the heart of anarchy, you lot've got to focus on what you can command: your attitude, your outlook and your actions. Of grade, a crash is scary. Yep, you'll take to brand some changes. But with the right plan to move forwards, yous tin can and volition continue to make progress. Here are five ways you can respond to a stock market crash:

i. Refuse to panic.

Like we said before, panic tin can brand the crash just as bad as the actual economic issues nosotros're facing. Don't fall for it. Dealing with the unknown creates uncertainty, and dubiety left unchecked can become fear. Cull to stay clear and positive with your thoughts.

2. Cut back on everything.

You can't control how Congress makes their budget, only you can control howyou make your budget! If yous lose your chore in the middle of an economic downturn, that means it's time to cutting outall unnecessary spending ofany blazon.

Cancel your gym membership and avoid going on an online shopping spree! Meal plan to save coin. Use up the food that you lot have in your pantry and freezer before you even recall well-nigh eating out at a restaurant.

Focus on funding the Iv Walls before spending money on annihilation else:

- Food

- Utilities

- Shelter

- Transportation

three. Follow the proven plan.

Pelting or shine, the Baby Steps don't change. They're the proven programme for managing your coin, and they piece of work! You need to understand which pace you lot're on and then piece of work the program.

If you've lost your income: Focus on piling up as much cash every bit yous can. You can intermission paying extra toward debt right at present. As much as that stinks, don't worry—it's not forever. When the tough time passes—and it volition—then you tin beginning back up and pay extra on your debt.

If your income is stable: Continue right on working the Baby Steps like yous were, and don't pause your debt snowball. Stay on the plan!

4. If you're investing, stay invested.

If you lot're on Baby Footstep four, go along investing 15% of your income (unless yous need to pause for a while considering you lost your income). Lots of people are tempted to cash out their 401(m) or mutual funds when the market takes a olfactory organ dive before they "lose whatsoever more money." But if you pull out at present, you'll guarantee a loss. Stay plugged in and ride it out to give your investments more time to abound and recover. Don't try to time the marketplace. Focus onfourth dimension in the marketplace.

v. Meet with an investment professional.

When in that location are large shifts in the market, schedule a telephone call with your investment professional person. Y'all need specific advice for your situation—your historic period, your funds, the types of retirement accounts you have, and which Baby Step you're on. Ask your pro if you demand to make any changes considering of the crash. Don't be afraid to share what'due south on your heed. If you're married, make sure your spouse is on the call! Make a program for how y'all'll move frontward together.

And by the mode, if you've been playing the investment game without a pro in your corner—don't. Connect with an investment professional person in your surface area.

Stay Calm During a Stock Market place Crash

You've got to choose to be patient and think long term here. No matter what the residue of 2022 has in store, remind yourself of the things you know to be true. You care nearly your family, your dreams and your future—and so make your investment decisions with those things in heed. You lot'll do a much ameliorate job of that if you stay positive and focus on the factors that youtin command.

Almost the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/retirement/stock-market-crash#:~:text=Let's%20get%20one%20thing%20straight,t%20make%20this%20stuff%20up!

0 Response to "Is It Possible That the Stock Market Could Crash Again"

Post a Comment